Starting and running a business is an exhilarating journey filled with opportunities for growth and success.

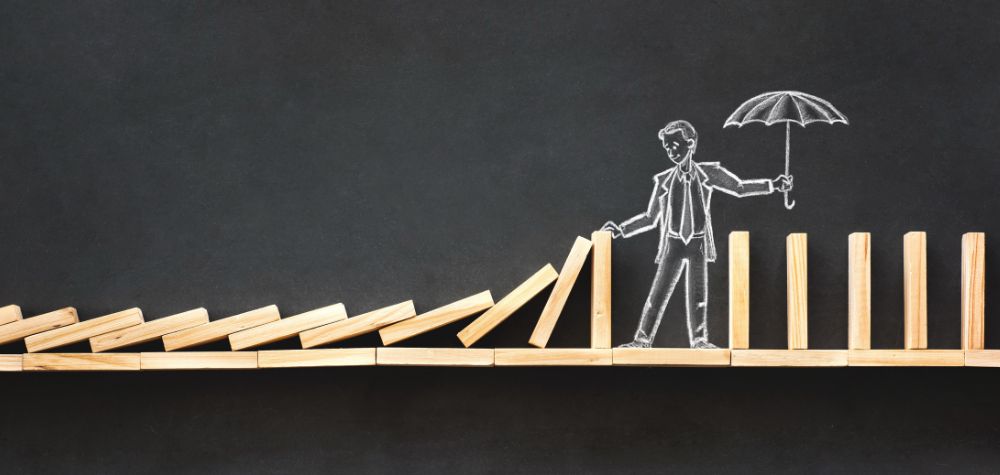

However, along the way, entrepreneurs inevitably encounter trials and tribulations that test their resilience and determination.

From economic downturns to unexpected setbacks, here are some common challenges businesses face and strategies for overcoming them:

Economic Uncertainty:

- Economic downturns, market fluctuations, and global crises can significantly impact businesses of all sizes. During times of uncertainty, it’s crucial for businesses to reassess their strategies, streamline operations, and prioritise financial stability. Diversifying revenue streams, reducing unnecessary expenses, and maintaining open communication with stakeholders can help businesses weather economic storms.

Competition:

- In today’s competitive business landscape, standing out from the crowd is essential for success. Businesses must continuously innovate, differentiate their offerings, and deliver exceptional customer value. Conducting thorough market research, understanding competitors’ strengths and weaknesses, and leveraging unique selling propositions are key strategies for staying ahead.

Cash Flow Management:

- Cash flow challenges are a common concern for businesses, particularly startups and small enterprises. Poor cash flow management can lead to liquidity issues, missed opportunities, and even business failure. Implementing effective cash flow forecasting, establishing clear payment terms with customers and suppliers, and exploring financing options such as lines of credit or business loans can help businesses maintain healthy cash flow.

Talent Acquisition and Retention:

Recruiting and retaining top talent is critical for business growth and success. However, finding and keeping skilled employees engaged can be daunting.

Offering competitive salaries and benefits, providing opportunities for professional development and career advancement, and fostering a positive work culture are essential for attracting and retaining talent. Implementing robust recruitment and onboarding processes can help businesses identify and onboard the right candidates.

Technology Disruption:

Rapid advancements in technology have transformed industries and disrupted traditional business models. Businesses that fail to adapt to technological changes risk falling behind their competitors.

Embracing digital transformation, investing in innovative technologies, and leveraging data analytics to drive decision-making are essential for staying competitive in today’s digital age. Fostering a culture of innovation and agility within the organisation can help businesses adapt to evolving technological trends.

Regulatory Compliance:

Navigating complex regulatory requirements and compliance standards can pose significant challenges for businesses, particularly in highly regulated industries.

Failure to comply with regulations can result in fines, legal consequences, and damage to reputation. Establishing robust compliance processes, staying informed about relevant laws and regulations, and seeking professional guidance when needed are essential for ensuring regulatory compliance.

Customer Satisfaction:

Satisfying customers and building long-term relationships is crucial for business success. However, meeting customer expectations can be challenging, especially in today’s competitive marketplace.

Businesses must prioritise customer satisfaction, actively listen to feedback, and continuously improve products and services to meet evolving customer needs. Building strong customer relationships, delivering personalised experiences, and providing exceptional customer service are key strategies for fostering loyalty and driving business growth.

While businesses inevitably encounter trials and tribulations on their journey to success, with perseverance, resilience, and strategic planning, they can overcome these challenges and emerge stronger than ever.

Businesses can navigate obstacles and achieve their goals by addressing challenges proactively, staying agile and adaptable, and seeking support when needed. Remember, every challenge presents an opportunity for growth and learning, and with the right mindset and approach, businesses can turn adversity into an advantage.